Center for Problem-Oriented Policing

The Problem of Robbery at Automated Teller Machines

This guide addresses the problem of robbery of people using automated teller machines (ATMs) and night cash depositories.§ The guide begins by describing the problem and reviewing factors that increase the risks of ATM robbery. It then identifies a series of questions that might assist you in analyzing your local ATM robbery problem. Finally, it reviews responses to the problem and what is known about these from evaluative research and police practice.

§ Robberies at night cash depositories, at which cash can only be deposited, not withdrawn, are sufficiently similar to ATM robberies to make most of the responses similar. Hereafter, reference will be made only to ATMs, but unless otherwise noted, all information applies equally to night cash depositories.

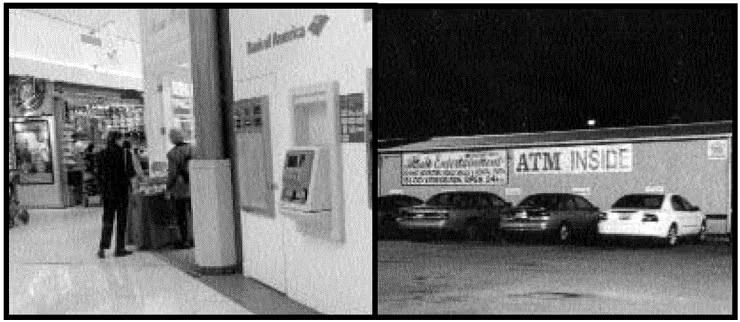

ATMs were first introduced in the mid-1960s in the United Kingdom, and in the late 1960s in the United States. The number of ATMs has increased dramatically since. ATM users now annually conduct billions of financial transactions, mostly cash withdrawals. Where once one would find ATMs only on bank premises, today one finds them almost everywhere—along sidewalks and in airports, grocery stores, shopping malls, nightclubs, and casinos. There are even mobile ATMs that can be set up at disaster sites or temporary entertainment venues like fairgrounds. Bank customers have come to expect that they can access their funds virtually any time and any place. To some extent, they have traded safety for convenience.

ATM services are highly profitable for banks, and banks aggressively market the use of ATM cards.§ ATMs that are off bank premises are usually more profitable for banks because they attract a higher volume of non-bank customers, who must pay service fees. Unfortunately, customers using off-premise ATMs are more vulnerable to robbery.

§ It has been estimated that in 1993, banks earned $2.55 billion in revenue from ATMs, saved $2.34 billion in wages for tellers and netted a profit of $2 billion (Deitch 1994; DeYoung 1995).

As yet, there are no routinely collected national figures on the incidence of U.S. ATM robberies.§§ Estimates are derived from periodic surveys of banks conducted by banking associations.§§§ According to those surveys, there was an estimated one ATM crime (including robbery) per 3.5 million transactions.§§§§ Statewide surveys conducted in California indicated there was one ATM crime per 1.9 million transactions in 1986, one per 1.2 million in 1992, and one per 2.5 million in 1995.1 Thus, the California figures suggest that the rate of ATM crime declined by about 50 percent during that brief period, although we do not know how well the bank survey data reflect the actual incidence of ATM crime. Moreover, the surveys covered all ATM-related crimes, not just robbery, so the figures overstate robbery rates (see below for related crimes).

§§ With a little effort, most local police agencies could compile data on ATM robberies, but until the FBI's National Incident-Based Reporting System becomes standard, the Uniform Crime Reports will not provide national data on the problem.

§§§ Most of the figures cited in the literature on ATM crime are from two surveys, conducted by the Bank Administration Institute and the American Bankers Association in 1987 and 1989, respectively.

§§§§ This figure is routinely cited in the Bank Administration Institute and American Bankers Association surveys.

The survey figures and findings are still cited as if they reflect current conditions, even though it is doubtful that they do. The best one can conclude is that the overall rate of ATM-related crime is somewhere between one per 1 million and one per 3.5 million transactions, suggesting that such crime is relatively rare. But the figures, without further analysis and some comparative context, do not tell us much about the risks of ATM robbery. Local analysis of ATM robberies will be necessary to determine how significant the problem is in your jurisdiction.

Related Problems

Robbery at ATMs is only one of several related problems the police must address. Other problems that call for separate analysis and responses, but which are not addressed in this guide, include:

- Robbery of couriers who fill ATMs with cash

- Theft of personal identification numbers (PINs) (including theft by "shoulder surfing")

- Theft by electronic data interception

- Theft by fraudulent electronic transactions

- Theft of money from ATMs by bank/ATM service employees

- Burglary of ATMs (including theft of entire ATMs)

- Presence of homeless people sleeping in ATM vestibules

- Vandalism of ATMs

- Fraudulent use of ATM cards obtained from customers through dummy ATMs that keep their cards.

Factors Contributing to Robbery at Automated Teller Machines

Understanding the factors that contribute to your problem will help you frame your own local analysis questions, determine good effectiveness measures, recognize key intervention points, and select appropriate responses.

A few studies, although they are becoming dated, have provided some data on common ATM robbery patterns.2 The general conclusions are as follows:

- Most robberies are committed by a lone offender—using some type of weapon—against a lone victim.

- Most occur at night, with the highest risk between midnight and 4 a.m.

- Most involve robbing people of cash after they have made a withdrawal.

- Robberies are somewhat more likely to occur at walk-up ATMs than at drive-through ATMs.

- About 15 percent of victims are injured.

- The average loss is between $100 and $200.

High rates of all types of street robbery, including ATM robbery, are likely to coincide with crack cocaine markets, as street robbery is a quick way for addicts to get the cash they need to buy crack, and it does not require a lot of planning or skill.

ATM robbery attracts a lot of media attention and public concern, most likely because the general public perceives that it can happen to almost anyone. Legislation regarding ATM customer safety has been introduced immediately after a prominent person, a legislator or someone close to a legislator has been robbed at an ATM.§

§ Among the prominent victims of ATM robbery in recent years are a former U.S. Secretary of Health and Human Services, who successfully resisted the offenders and later identified them; the son of Time-Warner Inc.'s CEO, who was also a popular New York City school teacher (he was murdered after his ATM card was taken and he was forced to reveal his PIN); a New York City councilwoman; police officers; and assistant district attorneys.

There are several additional and distinct ATM robbery patterns, each of which presents unique challenges in responding. As noted above, the most common pattern is for the offender to rob the ATM user immediately after the victim makes a withdrawal.3 Other patterns include the following:

- The offender forces the victim to go to an ATM to withdraw cash

- The offender robs the victim of his or her ATM card, forces the victim to reveal the PIN, and then uses the card

- The offender robs a victim standing at an ATM of other valuables (wallet, watch, jewelry)

- The offender follows someone who has just withdrawn cash from an ATM and robs him or her away from the ATM.

There is some evidence that offenders who commit street robbery (including ATM robbery) are different from those who commit commercial robbery.4 We do not know the extent to which ATM robbers commit other types of street robberies, like purse snatchings and muggings. Street robbers are notoriously difficult to deter. They require relatively small amounts of cash to justify their risk, they have a lot of crime opportunities, they want cash immediately, and street robbery does not require much skill or planning.5 Some robbers will adapt to technological prevention measures, finding ways to circumvent them.6 For example, surveillance equipment might lead robbers to disguise themselves.

Free Bound Copies of the Problem Guides

You may order free bound copies in any of three ways:

Online: Department of Justice COPS Response Center

Email: [email protected]

Phone: 800-421-6770 or 202-307-1480

Allow several days for delivery.

Email sent. Thank you.

Robbery at Automated Teller Machines

Send an e-mail with a link to this guide.

* required

Error sending email. Please review your enteries below.

To *

Separate multiple addresses with commas (,)

- Your Name *

Your E-mail *

Copy me

Note: (200 character limit; no HTML)

Please limit your note to 200 characters.